Help with Fees

Introduction

If you’d like your child to attend a Mama Bear’s Day Nursery and Pre-school you may be eligible for assistance with the cost through a number of initiatives. Details of current schemes can be found on this page. You are welcome to talk to your Nursery Manager, or alternatively please contact our Finance Department on 0117 958 2030 or by email, if you have any further questions.

Alternatively, for a quick overview visit the excellent Childcare Choices FAQ page here: Childcare entitlements- frequently asked questions for parents (1).docx - Google Docs (childcarechoices.gov.uk)

Early Years Entitlement for children from nine months old

For details of the Early Years Entitlement and how we deliver it please click on this link: Early Years Entitlement for children from nine months old | Mama Bear's Day Nursery

For more information, to register for updates and to apply for your code please visit Homepage | Best Start in Life

Best Start in Life (previously known as Childcare Choices)

The Government’s "Best Start in Life" website is a useful source of information if you are looking for support with your childcare costs. Best Start in Life brings together all the government childcare offers in one place. Use the Childcare Calculator at www.gov.uk/childcare-calculator to see what offers are available to support you and your family. Other schemes include Tax-Free Childcare and Free Extended Entitlement. Here is a guide to some useful information from Best Start in Life: Top Things Parents Need to Know

To find out more about what's on offer go to the Homepage | Best Start in Life website today.

Tax-free childcare

This is a Government scheme available for all working families, including those who are self-employed. For every £8 you pay in, the Government will add £2 (up to £2,000 per child). This can be used to pay for sessions in addition to the Free Entitlement. More information can be found on the Childcare Service website. Here is a document on more information on Tax-free childcare: Parents Guide to Tax-free Childcare

Childcare Vouchers

We accept vouchers from all the major and local suppliers, including Accor, Care4, B&NES, Sodexho, Faircare, All Save, Kiddi Vouchers, Early Years, Family Matters, Fideliti, Imagine/Mid Counties Co-op, Kids Unlimited, Busy Bees, Leapfrog, Bristol City Council (CIS), BAND and South Glos Council. Please get in touch if you have vouchers from another source.

Childcare element of Working Tax Credit

The Working Tax Credit has a Childcare element that will pay up to 70% of your childcare costs, up to £175 per week for families with childcare costs for one child and £300 per week for families with two or more children, subject to status. Parents / carers must be working a minimum of 16 hours per week.

Financial support for young parents and students

Care to Learn aims to give financial support up to £5,000 per child per year to teenage parents (including dads), who want to continue their education or training, or are returning to education or training and need help with the cost of their childcare. £32 million is also available through the Learner Support Scheme to help students with childcare costs. Priority is given to single parents and those on low incomes, and the fund can be used to support the costs of any registered childcare.

For more information on help with fees for student parents, as well as lots of other useful related information click here to visit the GOV.uk website.

Want more information?

Visit https://www.familyandchildcaretrust.org/help-your-childcare-costs for the Family and Childcare Trust 's excellent guide. Includes information for all families, including working parents, families living with a disability and student parents.

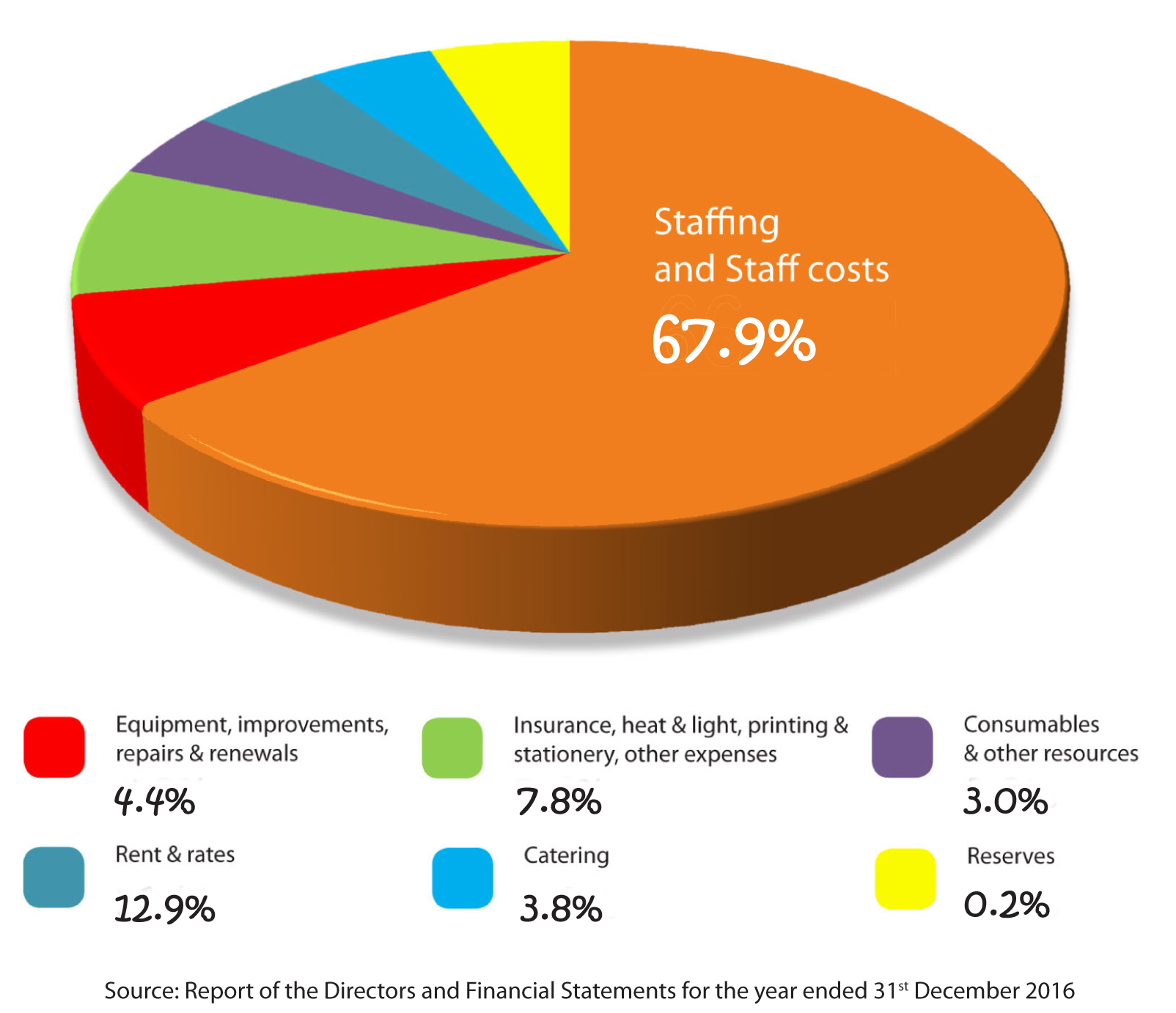

How your fees are spent